Tenstorrent

Founded Year

2016Stage

Series D | AliveTotal Raised

$1.02BValuation

$0000Last Raised

$693M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+35 points in the past 30 days

About Tenstorrent

Tenstorrent is a computing company specializing in hardware focused on AI within the technology sector. The company offers computing systems for the development and testing of AI models, including desktop workstations and rack-mounted servers powered by its Wormhole processors. Tenstorrent also provides an open-source software platform, TT-Metalium, for customers to customize and run AI models. It was founded in 2016 and is based in Toronto, Canada.

Loading...

ESPs containing Tenstorrent

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI accelerator modules market focuses on specialized hardware optimized for AI and machine learning tasks. As AI technology expands into new applications and fields, AI accelerators are crucial for processing the large data volumes needed for scalable AI applications. These accelerators significantly speed up deep learning, making breakthroughs like generative AI more feasible and cost-effecti…

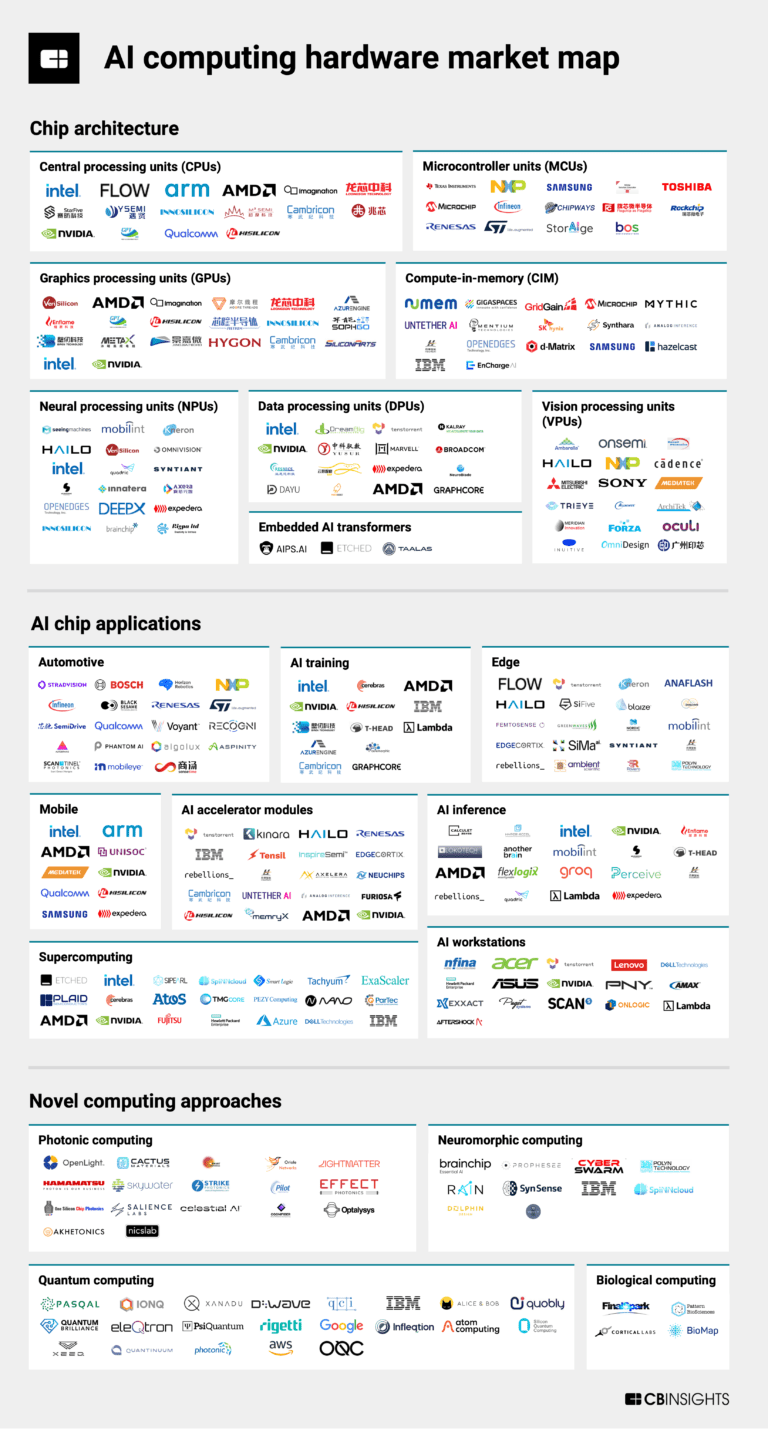

Tenstorrent named as Outperformer among 15 other companies, including Advanced Micro Devices, IBM, and Samsung.

Tenstorrent's Products & Differentiators

Grayskull E150

A 150W PCIe Gen4 board mounted with a single Tenstorrent 'Grayskull' chip. Targeted at GPU workstations and rack enclosures.

Loading...

Research containing Tenstorrent

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tenstorrent in 3 CB Insights research briefs, most recently on Sep 13, 2024.

Sep 13, 2024

The AI computing hardware market map

Apr 11, 2022

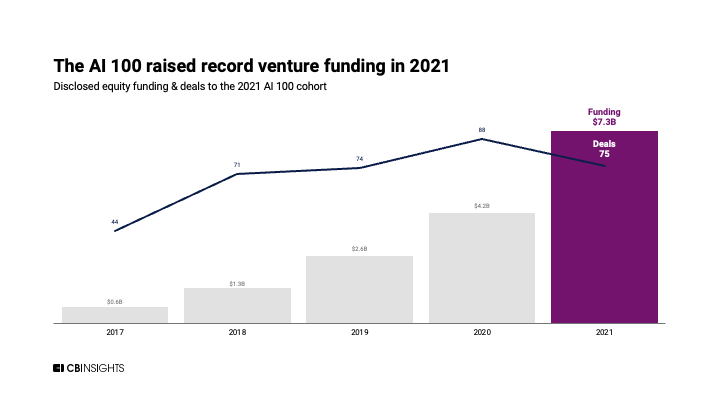

The top 100 AI startups of 2021: Where are they now?Expert Collections containing Tenstorrent

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tenstorrent is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

Artificial Intelligence

9,504 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

AI 100

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Semiconductors, Chips, and Advanced Electronics

7,308 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

AI 100 (2024)

100 items

Tenstorrent Patents

Tenstorrent has filed 39 patents.

The 3 most popular patent topics include:

- parallel computing

- microprocessors

- artificial neural networks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/8/2021 | 10/15/2024 | Computer memory, Models of computation, Microcontrollers, Computer arithmetic, Parallel computing | Grant |

Application Date | 12/8/2021 |

|---|---|

Grant Date | 10/15/2024 |

Title | |

Related Topics | Computer memory, Models of computation, Microcontrollers, Computer arithmetic, Parallel computing |

Status | Grant |

Latest Tenstorrent News

Feb 22, 2025

Love it or hate it, if President Trump's tariff-heavy threats have done one thing it's show the world that the US is serious about its chip industry. And if one company is synonymous with the US chip industry, it's Intel. But there are some tides that might be too strong to turn despite a new US administration, and it seems at least some are worried that this might describe Intel. After plenty of back-and-forth speculation about the possibility of various companies buying up parts of Intel, ex-AMD engineer and current Tenstorrent CEO Jim Keller has thrown his hat into the ring of opinion. Responding to an X post saying the Intel board "reportedly wants to sell off the company to unlock (likely one-time) shareholder value", Keller argues that "this is not unlocking shareholder value, it's a fire sale." "It makes me sad," Keller says, in a tone reminiscent of Bill Gates's recent lamentation over Intel's (and specifically Pat Gelsinger's) apparent failure to turn the company around . Rather than splitting up and selling off the company, the ex-AMD chip boffin has a more traditional value-building strategy in mind: "You build value by having a great goal and a team that loves working to the goal. Intel built the fastest CPUs on the best process." Further driving the point home, he posts again , saying: "I think a great Intel is worth $1 trillion. Seems a little careless to throw it away." The implication being, to me at least, let's make Intel great again. We can probably assume that's what the Trump administration will be thinking, too—add a MIGA to its MAGA, why not? A strong Intel means a strong US chip industry, and the alternative is selling off an Intel chipmaker to foreign companies, presumably tariffing the resultant chips into oblivion. The talk on the ground hasn't been settled of late—people can't seem to decide which company or companies would likely buy Intel's chip design and/or fabrication divisions. Conflicting reports had it that TSMC both was and also wasn't supposed to be in talks to buy Intel's fabs . And there's been talk of Broadcam acquiring the design side if another company such as TSMC took the fabs. A Broadcom sale would keep at least some of Intel in the hands of the US (well, a US-based company, at least), and this possibility is in fact what Keller was responding to. One of X posts he replied to asks: "Couldn't Intel's chip join the well run Broadcom family, Altera and Mobileye live their lives and Intel foundries become a national asset we protect and turn around?" Story Continues Broadcom taking Intel Chip and Intel foundries becoming a "national asset" would certainly keep things in the US, but would it make for a great Intel? Could we trust the state to succeed in making Intel great again? If Keller's correct and a good Intel can make for a $1 trillion chipmaking company, then maybe it would be a little careless to throw it away. Much of this will surely ride on whether the company's 18A node is up to snuff, and if Gelsinger's departure is anything to go by, I'm not filled with confidence. Whatever the case, we'll just have to see what the board decides to do and whether the US government decides to step in. Strange times, indeed. Best CPU for gaming : Top chips from Intel and AMD. Best gaming motherboard : The right boards. Best graphics card : Your perfect pixel-pusher awaits. Best SSD for gaming : Get into the game first. View Comments

Tenstorrent Frequently Asked Questions (FAQ)

When was Tenstorrent founded?

Tenstorrent was founded in 2016.

Where is Tenstorrent's headquarters?

Tenstorrent's headquarters is located at 150 Ferrand Drive , Toronto.

What is Tenstorrent's latest funding round?

Tenstorrent's latest funding round is Series D.

How much did Tenstorrent raise?

Tenstorrent raised a total of $1.02B.

Who are the investors of Tenstorrent?

Investors of Tenstorrent include Hyundai Motor Company, Export Development Canada, MESH Consultants, XTX Markets, Baillie Gifford and 22 more.

Who are Tenstorrent's competitors?

Competitors of Tenstorrent include Groq, Blaize, Graphcore, NeuReality, Pezzo and 7 more.

What products does Tenstorrent offer?

Tenstorrent's products include Grayskull E150 and 4 more.

Loading...

Compare Tenstorrent to Competitors

Mythic is an analog computing company that specializes in AI acceleration technology. Its products include the M1076 Analog Matrix Processor and M.2 key cards, which provide power-efficient AI inference for edge devices and servers. Mythic primarily serves sectors that require real-time analytics and data throughput, such as smarter cities and spaces, drones and aerospace, and AR/VR applications. Mythic was formerly known as Isocline Engineering. It was founded in 2012 and is based in Austin, Texas.

Cerebras focuses on artificial intelligence (AI) work in computer science and deep learning. The company offers a new class of computers, the CS-2, which is designed to train AI models efficiently with applications in natural language processing (NLP), computer vision, and computing. Cerebras primarily serves sectors such as health and pharma, energy, government, scientific computing, financial services, and web and social media. It was founded in 2016 and is based in Sunnyvale, California.

KnuEdge is a company that develops a compute fabric for machine intelligence within the technology sector. The company provides a cloud platform that supports machine learning and artificial intelligence applications. KnuEdge serves sectors that require computing solutions, including the technology and artificial intelligence industries. It is based in San Diego, California.

Another Brain operates as a company focusing on the development of artificial intelligence (AI) technologies. It specializes in the development of Organic AI, a new generation of artificial intelligence technology within the AI industry. The company offers a vision quality control solution called Blue Phosphor that uses AI algorithms for intelligent defect detection in industrial supply chains. It was founded in 2017 and is based in Paris, France.

BITMAIN manufactures the digital currency mining sector, specializing in mining servers. The company offers technology power efficiency and provides computational infrastructure solutions to the global blockchain network. It primarily serves the cryptocurrency mining industry. It was founded in 2013 and is based in Beijing, China.

Wave Computing is a company focused on revolutionizing artificial intelligence through its dataflow-based chips, systems, and software in the technology sector. The company's main offerings include high-performance, scalable, and power-efficient processors based on the RISC-V instruction set architecture, designed for high-end applications. These processors are primarily used in the automotive, high-performance computing and data center, and communications and networking sectors. It is based in Campbell, California.

Loading...