Prove Identity

Founded Year

2008Stage

Series I | AliveTotal Raised

$261.3MValuation

$0000Last Raised

$40M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-44 points in the past 30 days

About Prove Identity

Prove Identity focuses on digital identity verification and authentication across several business sectors. The company provides services such as consumer verification, identity management, and passwordless authentication solutions. Prove's services are applicable to industries like banking, healthcare, insurance, and e-commerce. Prove Identity was formerly known as Payfone. It was founded in 2008 and is based in New York, New York.

Loading...

Prove Identity's Product Videos

ESPs containing Prove Identity

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The know your customer (KYC) software market offers solutions for streamlining and automating customer identification and due diligence processes. These solutions help companies verify customer identities, perform background checks, detect suspicious activity, and support regulatory compliance. Many vendors in this market utilize technologies such as artificial intelligence, machine learning, and …

Prove Identity named as Highflier among 15 other companies, including Onfido, Jumio, and Alloy.

Prove Identity's Products & Differentiators

Prove Pre-Fill

Powered by Pinnacle™, Prove Pre-Fill® easily and securely expedites the digital onboarding process and improving consumer experience and reducing friction by pre-populating forms with verified identity information tied to authenticated identities. Consumers provide consent for Pre-Fill seamlessly to return verified name, address and other fields to pre-populate forms and ONLY the specified consumer will be able to autofill their info. For companies, Pre-Fill increases consumer acquisition, improves user experience, lowers costs, and mitigates fraud and the need for manual intervention/reviews.

Loading...

Research containing Prove Identity

Get data-driven expert analysis from the CB Insights Intelligence Unit.

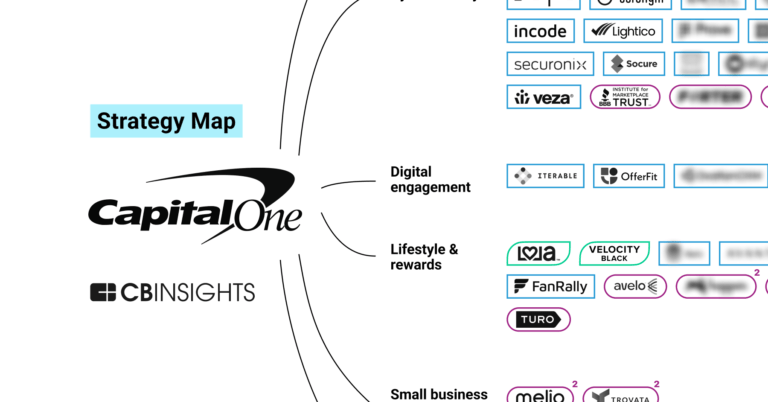

CB Insights Intelligence Analysts have mentioned Prove Identity in 7 CB Insights research briefs, most recently on Mar 18, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Prove Identity

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Prove Identity is included in 11 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,249 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

SMB Fintech

2,003 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Payments

3,085 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Cybersecurity

9,895 items

These companies protect organizations from digital threats.

Prove Identity Patents

Prove Identity has filed 34 patents.

The 3 most popular patent topics include:

- wireless networking

- computer network security

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/9/2022 | 11/12/2024 | Credit cards, Credit card issuer associations, Payment systems, Wireless networking, Google services | Grant |

Application Date | 3/9/2022 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | Credit cards, Credit card issuer associations, Payment systems, Wireless networking, Google services |

Status | Grant |

Latest Prove Identity News

Oct 10, 2024

By PYMNTS | October 10, 2024 | More than 30 years ago, a cartoon appeared in the New Yorker, now made famous by any number of memes and framed pictures — a canine perched at a computer, proclaiming: “On the Internet, no one knows you’re a dog.” Fast forward to the current Millennium, a quarter of a century old, and the sentiment holds true — verifying that the person on the other side of a screen, a device, a text message is who they say they are, is no small matter. “We’re living our lives, irrevocably, online,” Catherine Porter , chief business officer at Prove Identity , told PYMNTS. And identity — more specifically, verification of that identity — is a challenge that’s been compounded with artificial intelligence (AI) and other advanced technologies in the mix. Fraud is becoming more advanced online,” she said, and we’re living in an age where the tools fraudsters can use to buy identities online and use them as their own identities to commit crimes are advancing rapidly. “The ‘age of AI,’” she said, where AI helps in defrauding identities by replicating them, “is creating the necessity that consumers and the sites that build platforms for consumers have a layer of trust built into them.” Prove has been building that layer of trust over the course of more than a decade — across banking, healthcare and other industries, using phone centric verification that helps remove friction across interactions while bolstering security at the same time with its identity verification platform and network. The company has just announced the rollout of its Verified Users offering , which verifies and “persists” a digital checkmark that accompanies users across their various online journeys. Meeting Online First, In Person Later That verification is especially critical because, as Porter noted, “we’re making our local communities smaller as we interact with people that we’re meeting online first.” The platforms where we meet online are not just domestic, they’re global in scope. We meet online first, and then in a restaurant on a date. We hire plumbers sight unseen before they come into our house, and babysitters are no longer just referred by the neighbors. A hallmark of the online realm, of course, is the pseudonym, used to erect a wall of privacy for our identities as we take to online platforms that allow us to have a presence sans our real names. “But this does create some risk for the inevitable human to human connections,” Porter said. The Verified Users setting, she said, can cut across the various names enlisted by an individual, and Prove continuously verifies that individual as they live their online lives after a one-time, initial authentication. In terms of the mechanics of the new verification process, Porter said users sign up for an account, and as part of the platform, the firm verifies one’s identity against their mobile phone number. With 9 of the top 10 banks using Prove’s account opening technology for more than a decade, she said, “we’ve verified 90% of adults in the U.S. with 100% accuracy.” The company, she added, does not hold consumers’ private information (PII). The associated identity held in a client firm’s database is verified and encrypted, and can be used to ward off potential fraudsters or even bots that are swarming across platforms. For regulators, the verification can be valuable in establishing whether someone online posing as an adult is actually a minor. “It all goes back to the telephony signals and the authoritative data that we use to say, ‘are you a verified human? Are you an adult?’” Adults, after all, have likely held the same phone number for decades, which in turn implies that there exist plenty of “signals” to ascertain their identities. Looking ahead, Porter said that Prove will continue to expand into its key verticals, and over the longer term, with Verified Users, rewarding “good users” across a platform as they conduct commerce. As she told PYMNTS, “we’ll take the identification verification that we’ve used successfully in the banking environment, and port it to the digital marketplaces to help keep those consumers safe.” Recommended

Prove Identity Frequently Asked Questions (FAQ)

When was Prove Identity founded?

Prove Identity was founded in 2008.

Where is Prove Identity's headquarters?

Prove Identity's headquarters is located at 245 Fifth Avenue, New York.

What is Prove Identity's latest funding round?

Prove Identity's latest funding round is Series I.

How much did Prove Identity raise?

Prove Identity raised a total of $261.3M.

Who are the investors of Prove Identity?

Investors of Prove Identity include MassMutual Ventures, Capital One Ventures, Stack Capital, Plug and Play Fintech Accelerator, RRE Ventures and 25 more.

Who are Prove Identity's competitors?

Competitors of Prove Identity include Veriff, Fourthline, ThetaRay, Socure, Identomat and 7 more.

What products does Prove Identity offer?

Prove Identity's products include Prove Pre-Fill and 3 more.

Who are Prove Identity's customers?

Customers of Prove Identity include Synchrony, Tabula Rasa, Binance, Varo and Bilt Rewards.

Loading...

Compare Prove Identity to Competitors

Socure is a platform in the digital identity verification and trust sector, utilizing artificial intelligence and machine learning within the financial services, government, gaming, healthcare, telecom, and e-commerce industries. The company offers a predictive analytics platform that employs AI and machine learning techniques to verify identities in real time, using online and offline data intelligence such as email, phone, address, IP, device, and velocity. Socure's clientele includes a range of sectors, primarily focusing on financial services, government, and technology-driven industries. It was founded in 2012 and is based in Incline Village, Nevada.

Veriff specializes in artificial intelligence-powered identity verification within the fraud prevention and compliance sectors. Their platform offers services to verify user identities, which are used to prevent fraud and ensure compliance with regulations. Its solutions are utilized across various industries including financial services, mobility, crypto, gaming, education, and healthcare. The company was founded in 2015 and is based in Tallinn, Estonia.

Sumsub develops an identity verification service operating within the compliance and fraud prevention sectors. The company provides a service for verifying users, businesses, and transactions, as well as monitoring for suspicious activities and preventing fraud through machine learning algorithms. It serves industries such as fintech, online gaming, trading, crypto, and transportation. The company was founded in 2015 and is based in London, United Kingdom.

Mitek Systems provides mobile capture and digital identity verification solutions in the technology sector. The company offers products like an identity verification platform, biometric authentication, and mobile deposit services for businesses to verify user identities during digital transactions. Mitek's solutions serve financial institutions, fintech companies, and other businesses in regulated markets, focusing on financial risk and compliance requirements. Mitek Systems was formerly known as Mitek Systems of Delaware, Inc.. It was founded in 1986 and is based in San Diego, California.

Au10tix focuses on identity verification and fraud prevention within sectors like finance, e-commerce, and technology. The company provides services including document verification, biometric identification, and compliance solutions. Au10tix's offerings include tools for KYC, AML, and age verification. It was founded in 2005 and is based in Hod Hasharon, Israel.

Trulioo focuses on global online identity verification and operates within the technology and security sectors. The company offers services such as individual and business identity verification, watchlist screening, and identity document verification, all aimed at ensuring know-your-customer (KYC) and know-your-business (KYB) compliance. Trulioo primarily serves sectors such as banking, cryptocurrency, online trading, and wealth management. It was founded in 2011 and is based in Vancouver, Canada.

Loading...