Clip

Founded Year

2012Stage

Series E | AliveTotal Raised

$547.36MValuation

$0000Last Raised

$100M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+28 points in the past 30 days

About Clip

Clip is a financial technology company that specializes in providing payment solutions and mobile point-of-sale systems for businesses. The company offers a range of products including card readers, portable terminals, and digital services that facilitate remote payments, inventory management, and financial services such as loans. Clip primarily serves various business sectors, offering tailored solutions for online and physical stores, professional services, and the food and beverage industry. Clip was formerly known as BlitzPay. It was founded in 2012 and is based in Mexico City, Mexico.

Loading...

ESPs containing Clip

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

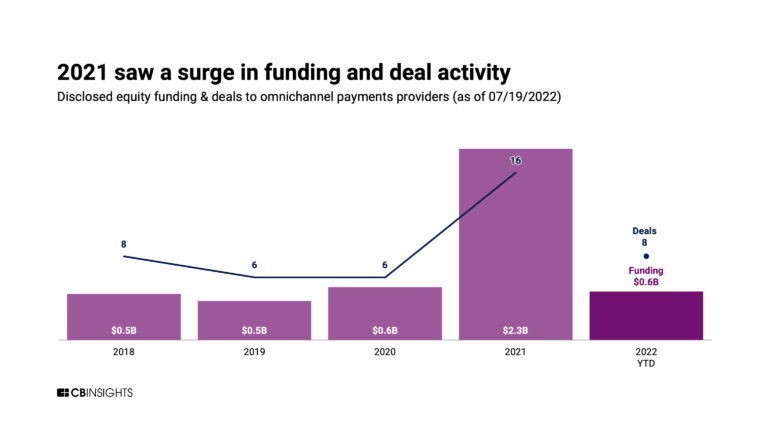

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Clip named as Challenger among 15 other companies, including Stripe, Fiserv, and Shopify.

Loading...

Research containing Clip

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clip in 4 CB Insights research briefs, most recently on Nov 17, 2022.

Mar 15, 2022 report

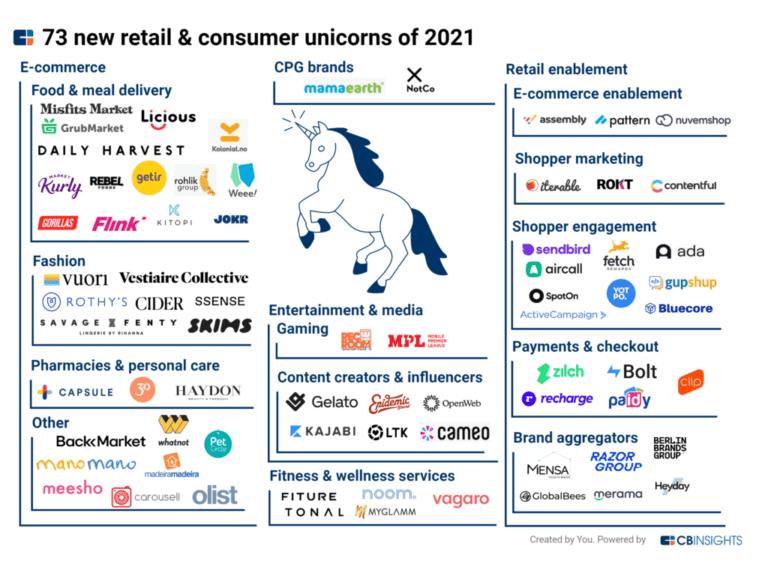

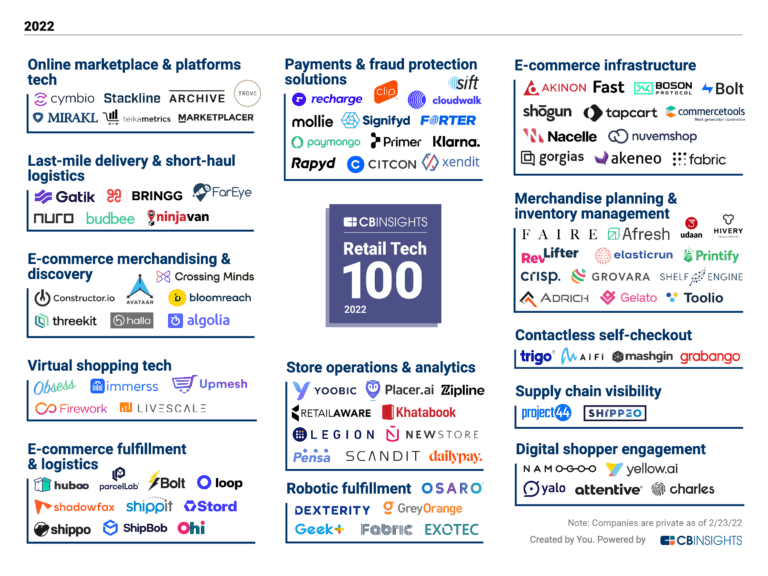

The Retail Tech 100: The top retail tech companies of 2022Expert Collections containing Clip

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clip is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,739 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,257 items

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Retail Tech 100

200 items

The most promising B2B tech startups transforming the retail industry.

Clip Patents

Clip has filed 8 patents.

The 3 most popular patent topics include:

- actuators

- bicycles

- cycle types

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/25/2020 | 1/9/2024 | Cycle types, Actuators, Bicycles, Electric bicycles, Cycling | Grant |

Application Date | 3/25/2020 |

|---|---|

Grant Date | 1/9/2024 |

Title | |

Related Topics | Cycle types, Actuators, Bicycles, Electric bicycles, Cycling |

Status | Grant |

Latest Clip News

Dec 10, 2024

Keep up to Date with Latin American VC, Startups News Clip, Mexico’s leading digital payments and commerce platform, has secured a $100 million investment from Morgan Stanley Tactical Value (MSTV) and a major West Coast mutual fund manager. Founded in 2012, Clip has developed a comprehensive suite of payment solutions, financial services, and software for small and mid-sized businesses (SMBs) in Mexico. The company’s offerings include hardware and software products that enable SMBs to accept digital payments, sell online, access credit, and streamline operations. Adolfo Babatz, Clip’s Founder and CEO, stated that the new funds will be used to accelerate product development initiatives. The investment aims to support Clip’s mission of driving financial inclusion in Mexico through innovative technology solutions for SMBs across the country. Pedro Teixeira, Managing Director and Co-Head of MSTV, expressed enthusiasm for the partnership, praising Clip’s role in leveraging technology to promote financial inclusion in Mexico. He highlighted the company’s experienced management team, customer-focused culture, and strong performance record as key factors in the investment decision. Clip’s existing investors include prominent names such as General Atlantic, Ribbit Capital, Goldman Sachs, SoftBank Latin America Fund, and Viking Global Investors. The addition of MSTV and the West Coast mutual fund manager further strengthens Clip’s position in the Mexican fintech market. With offices in Mexico City and Buenos Aires, Clip continues to expand its reach and impact on the Mexican commerce ecosystem. The company remains focused on empowering businesses to interact more effectively with consumers through innovative technologies and comprehensive digital payment solutions.

Clip Frequently Asked Questions (FAQ)

When was Clip founded?

Clip was founded in 2012.

Where is Clip's headquarters?

Clip's headquarters is located at Avenida Insurgentes Sur #1457, Colonia Insurgentes Mixcoac, Alcaldía Benito Juárez, Mexico City.

What is Clip's latest funding round?

Clip's latest funding round is Series E.

How much did Clip raise?

Clip raised a total of $547.36M.

Who are the investors of Clip?

Investors of Clip include General Atlantic, SoftBank Latin America Fund, Angel Ventures Mexico, Ribbit Capital, Viking Global Investors and 21 more.

Who are Clip's competitors?

Competitors of Clip include Moov, Revel Systems, SumUp, Stripe, NearPay and 7 more.

Loading...

Compare Clip to Competitors

Stripe is a financial infrastructure platform that provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interface (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as ecommerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Priority Payment Solutions focuses on providing integrated payments and banking solutions within the financial services industry. The company offers a scalable native platform for payment processing, accounts payable automation, and a suite of services for merchants, financial institutions, and other business sectors. Priority Payment Solutions primarily serves sectors such as merchant services, financial wellness, and property management. It was founded in 2005 and is based in Alpharetta, Georgia.

KIT is a clienteling software for the retail industry. It features assisted selling, store operations, integration and customization, and more. It is based in London, United Kingdom.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

KB Kookmin Card is a payment solutions provider and a subsidiary of KB Financial Group. The company offers services including credit card issuance and payment processing solutions, as well as technology payment methods such as quick response (QR) codes and direct debit. KB Kookmin Card also provides white-label payment solutions and PaaS (Payment As A Service) for cross-border payments. It was founded in 2011 and is based in Seoul, South Korea. KB Kookmin Card operates as a subsidiary of KB Bukopin.

Loading...