Klaviyo

Founded Year

2012Stage

IPO | IPOTotal Raised

$778.5MDate of IPO

9/20/2023Market Cap

10.74BStock Price

40.18Revenue

$0000About Klaviyo

Klaviyo (KVYO) specializes in marketing automation within the digital marketing industry. It offers a SaaS platform that enables businesses to utilize first-party data for personalized communication across email, SMS, and push notifications. The company's services are primarily utilized by businesses looking to engage and retain customers through data-driven marketing strategies. It was founded in 2012 and is based in Boston, Massachusetts.

Loading...

ESPs containing Klaviyo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The marketing automation personalization market is focused on providing personalized and relevant experiences to customers across various digital channels. Vendors in this market offer solutions that use AI and data analytics to create personalized content and messaging for each customer, resulting in increased engagement, conversion rates, and customer loyalty. The market includes a range of prod…

Klaviyo named as Highflier among 15 other companies, including Bloomreach, Oracle, and Attentive.

Loading...

Research containing Klaviyo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Klaviyo in 8 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024 report

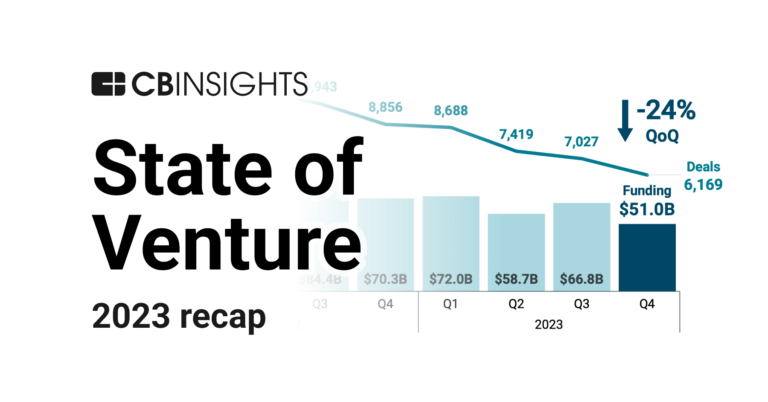

State of Venture 2023 Report

Nov 21, 2023

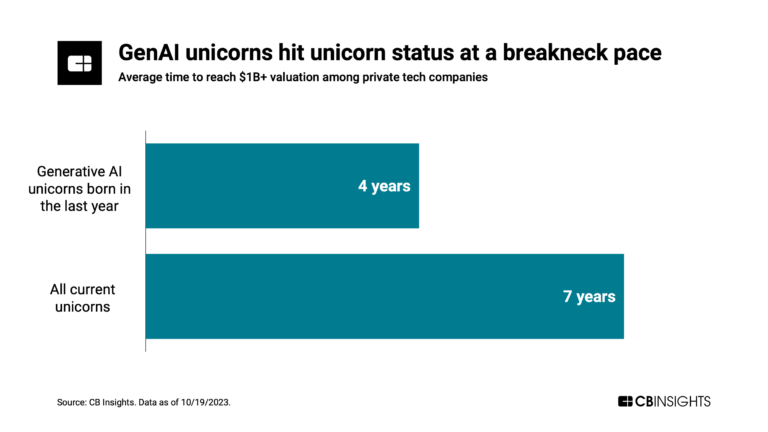

Has the global unicorn club reached its peak?

Nov 20, 2023 report

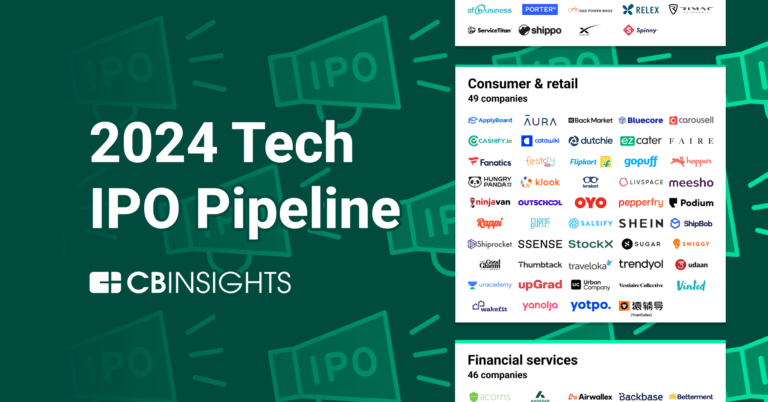

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 Report

Aug 14, 2023

The cookieless targeting market map

Oct 18, 2022

The Transcript from Yardstiq: Is Okta an M&A target?

Oct 12, 2022 report

Top marketing automation companies — and why customers chose themExpert Collections containing Klaviyo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Klaviyo is included in 4 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Targeted Marketing Tech

453 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Loyalty & Rewards Tech

178 items

NRF Big Show 2025: Exhibitors

959 items

Klaviyo Patents

Klaviyo has filed 33 patents.

The 3 most popular patent topics include:

- data management

- digital marketing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/13/2022 | 12/3/2024 | Digital marketing, Email, Data management, Promotion and marketing communications, Speed (TV channel) shows | Grant |

Application Date | 6/13/2022 |

|---|---|

Grant Date | 12/3/2024 |

Title | |

Related Topics | Digital marketing, Email, Data management, Promotion and marketing communications, Speed (TV channel) shows |

Status | Grant |

Latest Klaviyo News

Jan 16, 2025

15,066 Shares in Klaviyo, Inc. (NYSE:KVYO) Acquired by Capital Investment Advisors LLC Posted by MarketBeat News on Jan 16th, 2025 Capital Investment Advisors LLC purchased a new position in shares of Klaviyo, Inc. ( NYSE:KVYO – Free Report ) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 15,066 shares of the company’s stock, valued at approximately $621,000. Several other institutional investors and hedge funds have also recently bought and sold shares of KVYO. Arizona State Retirement System increased its position in Klaviyo by 67.1% during the second quarter. Arizona State Retirement System now owns 16,221 shares of the company’s stock worth $404,000 after purchasing an additional 6,512 shares during the last quarter. Renaissance Technologies LLC increased its position in Klaviyo by 40.8% during the second quarter. Renaissance Technologies LLC now owns 238,900 shares of the company’s stock worth $5,946,000 after purchasing an additional 69,200 shares during the last quarter. Blair William & Co. IL increased its position in Klaviyo by 14.3% during the second quarter. Blair William & Co. IL now owns 200,680 shares of the company’s stock worth $4,995,000 after purchasing an additional 25,149 shares during the last quarter. XTX Topco Ltd increased its position in Klaviyo by 114.7% during the second quarter. XTX Topco Ltd now owns 24,363 shares of the company’s stock worth $606,000 after purchasing an additional 13,016 shares during the last quarter. Finally, Canada Pension Plan Investment Board acquired a new stake in shares of Klaviyo in the second quarter worth $747,000. Institutional investors and hedge funds own 45.43% of the company’s stock. Get Klaviyo alerts: Wall Street Analysts Forecast Growth KVYO has been the subject of several recent research reports. Wells Fargo & Company increased their price objective on shares of Klaviyo from $37.00 to $41.00 and gave the stock an “equal weight” rating in a research report on Tuesday, January 7th. Needham & Company LLC increased their price objective on shares of Klaviyo from $40.00 to $46.00 and gave the stock a “buy” rating in a research report on Thursday, November 7th. Benchmark dropped their price objective on shares of Klaviyo from $42.00 to $40.00 and set a “buy” rating for the company in a research report on Thursday, November 7th. Macquarie reissued a “neutral” rating and issued a $36.00 price objective on shares of Klaviyo in a research report on Friday, November 8th. Finally, Robert W. Baird increased their price objective on shares of Klaviyo from $42.00 to $45.00 and gave the stock an “outperform” rating in a research report on Thursday, November 7th. Four analysts have rated the stock with a hold rating and fourteen have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of “Moderate Buy” and a consensus price target of $42.29. Want More Great Investing Ideas? Insider Buying and Selling at Klaviyo In other Klaviyo news, President Stephen Eric Rowland sold 4,536 shares of the stock in a transaction on Monday, November 18th. The shares were sold at an average price of $34.56, for a total transaction of $156,764.16. Following the transaction, the president now directly owns 186,785 shares in the company, valued at $6,455,289.60. This represents a 2.37 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link . Also, insider Landon Edmond sold 40,000 shares of the stock in a transaction on Tuesday, January 7th. The shares were sold at an average price of $41.80, for a total transaction of $1,672,000.00. Following the transaction, the insider now owns 298,607 shares in the company, valued at $12,481,772.60. This trade represents a 11.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here . Insiders have sold 154,536 shares of company stock worth $5,909,146 in the last ninety days. 53.24% of the stock is owned by insiders. Klaviyo Trading Up 1.3 % Shares of KVYO stock opened at $40.07 on Thursday. The company has a market capitalization of $10.80 billion, a PE ratio of -222.60 and a beta of 0.57. The firm has a fifty day simple moving average of $39.24 and a 200-day simple moving average of $34.11. Klaviyo, Inc. has a twelve month low of $21.26 and a twelve month high of $44.77. Klaviyo ( NYSE:KVYO – Get Free Report ) last posted its quarterly earnings data on Wednesday, November 6th. The company reported $0.15 EPS for the quarter, beating analysts’ consensus estimates of $0.11 by $0.04. Klaviyo had a negative net margin of 5.23% and a positive return on equity of 0.86%. The firm had revenue of $235.09 million for the quarter, compared to the consensus estimate of $226.33 million. During the same period in the prior year, the firm posted ($1.24) EPS. The firm’s revenue was up 33.7% compared to the same quarter last year. Equities research analysts predict that Klaviyo, Inc. will post 0.03 EPS for the current year. Klaviyo Profile Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure. Featured Articles

Klaviyo Frequently Asked Questions (FAQ)

When was Klaviyo founded?

Klaviyo was founded in 2012.

Where is Klaviyo's headquarters?

Klaviyo's headquarters is located at 125 Summer Street, Boston.

What is Klaviyo's latest funding round?

Klaviyo's latest funding round is IPO.

How much did Klaviyo raise?

Klaviyo raised a total of $778.5M.

Who are the investors of Klaviyo?

Investors of Klaviyo include Shopify Ventures, Summit Partners, Accel, Lone Pine Capital, Glynn Capital Management and 13 more.

Who are Klaviyo's competitors?

Competitors of Klaviyo include Bluecore, Brevo, Madwire, Blueshift, Amped and 7 more.

Loading...

Compare Klaviyo to Competitors

ActiveCampaign focuses on customer experience automation, operating within the marketing automation, email marketing, and Customer Relationship Management (CRM) sectors. The company offers services, including email marketing, marketing automation, e-commerce marketing, and CRM tools designed to help businesses engage meaningfully with their customers. ActiveCampaign primarily serves businesses of all sizes across various sectors, with a particular emphasis on the e-commerce industry. It was founded in 2003 and is based in Chicago, Illinois.

Brevo provides customer relationship management and marketing services. The company offers tools for businesses to execute digital marketing campaigns, send transactional messages, and utilize marketing automation features. It primarily serves the marketing industry. Brevo was formerly known as SendinBlue. It was founded in 2012 and is based in Paris, France.

Rokt focuses on electronic commerce technology. The company offers solutions to increase revenue, acquire customers at scale, and form relationships with existing customers. Its solutions include optimizing and monetizing the checkout experience, providing payment providers during checkout, and offering premium post-purchase offers. The company operates in the e-commerce sector. It was founded in 2012 and is based in New York, New York.

Bluecore specializes in retail marketing technology and focuses on shoppers identification and customer movement to drive incremental revenue for enterprise brands. The company offers solutions that enable retailers to convert anonymous shoppers into known customers and automate personalized marketing campaigns across email, mobile, site, and paid media. Bluecore was formerly known as TriggerMail. It was founded in 2013 and is based in New York, New York.

Attentive provides a personalized text messaging platform. It offers a short message service (SMS) marketing platform allowing retail and electronic commerce brands to connect with consumers, providing solutions such as marketing automation, growth marketing, retention marketing, audience management, messaging, and business intelligence. It offers its services to electronic commerce and the retail sector. The company was founded in 2016 and is based in Hoboken, New Jersey.

ForMotiv specializes in behavioral analytics within the insurance sector and provides insights into the intent and risk associated with digital applicants. The company offers solutions that analyze behavioral data in real-time to predict user intent and assess risk, which aids in improving conversion rates and reducing fraud. ForMotiv's services are primarily utilized by the insurance industry, enhancing digital experiences and decision-making processes for life, home, auto, and commercial insurance providers. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Loading...