Bunq

Founded Year

2012Stage

Series B - III | AliveTotal Raised

$368.05MLast Raised

$31.41M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+3 points in the past 30 days

About Bunq

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Loading...

Bunq's Product Videos

Bunq's Products & Differentiators

bunq account in 5 minutes

Bank account that's ready to use in 5 minutes

Loading...

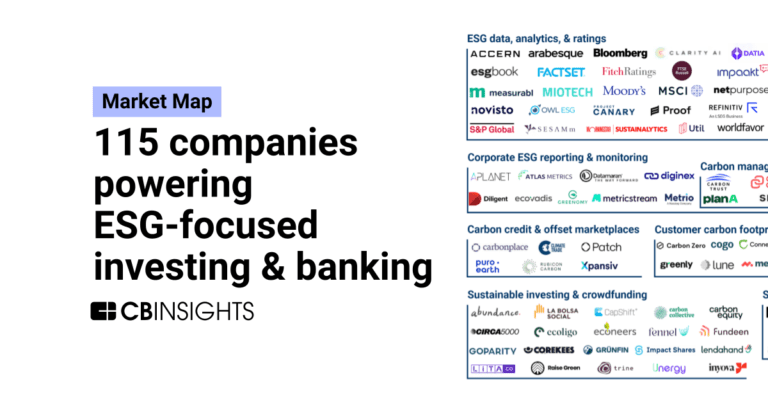

Research containing Bunq

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bunq in 1 CB Insights research brief, most recently on May 24, 2023.

Expert Collections containing Bunq

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bunq is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech

13,559 items

Excludes US-based companies

Digital Banking

1,059 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

100 items

Bunq Patents

Bunq has filed 3 patents.

The 3 most popular patent topics include:

- banking

- banking technology

- international taxation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2017 | 11/6/2018 | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop | Grant |

Application Date | 5/18/2017 |

|---|---|

Grant Date | 11/6/2018 |

Title | |

Related Topics | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop |

Status | Grant |

Latest Bunq News

Jan 20, 2025

Share this post: bunq , the second-largest neobank in Europe, announce their expanded collaboration with Mastercard , as the challenger bank introduces a range of benefits for its small business (SME) users across Europe. These tailored benefits reward bunq’s business users with a range of discounted tools and solutions designed to help small businesses thrive. Through Mastercard’s Business Bonus, bunq’s business users gain access to merchant discounts and offers, including on business software, travel, shipping, and freelance contracting. The programme is specifically designed to help small and medium-sized businesses save money and benefit from innovative resources and digital tools, allowing them to focus on core business activities and achieve growth. “When small businesses win, everyone wins. At Mastercard, we are committed to working with partners to support small businesses throughout Europe, enabling them to reach their full potential. We are pleased to collaborate with bunq to introduce the Mastercard Business Bonus programme to their small business cardholders, providing a range of tailored and relevant offerings to help their businesses grow,” says Audrey Bui Khac, Europe SME Segment Lead, Mastercard. The Business Bonus programme will be available to bunq’s business users in the Netherlands, Germany, France, Spain, and Italy. For more information on Mastercard Business Bonus, visit www.mastercard.com/businessbonus/en/home . People In This Post News News Crypto News Insurtech

Bunq Frequently Asked Questions (FAQ)

When was Bunq founded?

Bunq was founded in 2012.

Where is Bunq's headquarters?

Bunq's headquarters is located at Naritaweg 131-133, Amsterdam.

What is Bunq's latest funding round?

Bunq's latest funding round is Series B - III.

How much did Bunq raise?

Bunq raised a total of $368.05M.

Who are the investors of Bunq?

Investors of Bunq include Pollen Street Capital.

Who are Bunq's competitors?

Competitors of Bunq include Monese, Allica Bank, Qonto, Finom, Vivid Money and 7 more.

What products does Bunq offer?

Bunq's products include bunq account in 5 minutes and 4 more.

Loading...

Compare Bunq to Competitors

Tide offers a financial business platform offering digital banking services in the financial sector. The company provides FSCS-protected bank accounts in partnership with ClearBank and e-money accounts through PrePay Solutions, with a suite of business account administration tools including accounting software integration, expense management, and customizable invoicing. Tide caters to UK and Indian SMEs with a focus on saving time and money for its members. It was founded in 2015 and is based in London, United Kingdom.

Qonto provides business banking solutions for various company sizes and sectors. The company offers financial services including online business accounts, payment cards, international and local payment processing, loans, invoicing, expense management, and accounting integration. It serves self-employed individuals, freelancers, micro-businesses, small and medium enterprises, and associations across Europe. The company was founded in 2016 and is based in Paris, France.

Lydia is a financial technology company that specializes in mobile and digital banking services. The company offers a range of products, including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2013 and is based in Paris, France.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

ConnectPay is a financial platform operating in the fintech industry. The company offers a range of services including banking for businesses and individuals, cross-border and multi-currency payments, and merchant services. It primarily serves online businesses, marketplaces, and fintechs. It was founded in 2017 and is based in Vilnius, Lithuania.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

Loading...