Altruist

Founded Year

2018Stage

Series E | AliveTotal Raised

$449.5MValuation

$0000Last Raised

$169M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Altruist

Altruist operates as a custodian that provides technology solutions for independent financial advisors within the financial services industry. The company offers a suite of products that facilitate digital account management, portfolio management, trading, reporting, and billing to streamline the operations of Registered investment advisors (RIAs). Its platform is designed to support RIAs in improving their client experience, improving operational efficiency, and growing their businesses. It was founded in 2018 and is based in Culver City, California.

Loading...

ESPs containing Altruist

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automatic portfolio rebalancing software market provides investment management solutions that automatically adjust portfolio holdings to maintain target asset allocations to financial advisors at wealth management firms. This market is driven by factors such as the increasing adoption of automated investment platforms by financial advisors and wealth management home offices, the growing demand…

Altruist named as Highflier among 11 other companies, including SEI Investments, SS&C Technologies, and Envestnet.

Altruist's Products & Differentiators

Altruist

Altruist fully integrates brokerage services and essential portfolio management software (including its Model Marketplace - https://bit.ly/36H0ZxO) into a single platform, empowering financial advisors to run their business 100% digitally while radically lowering costs, growing faster, eliminating paperwork and supporting their clients seamlessly.

Loading...

Research containing Altruist

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Altruist in 3 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing Altruist

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Altruist is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

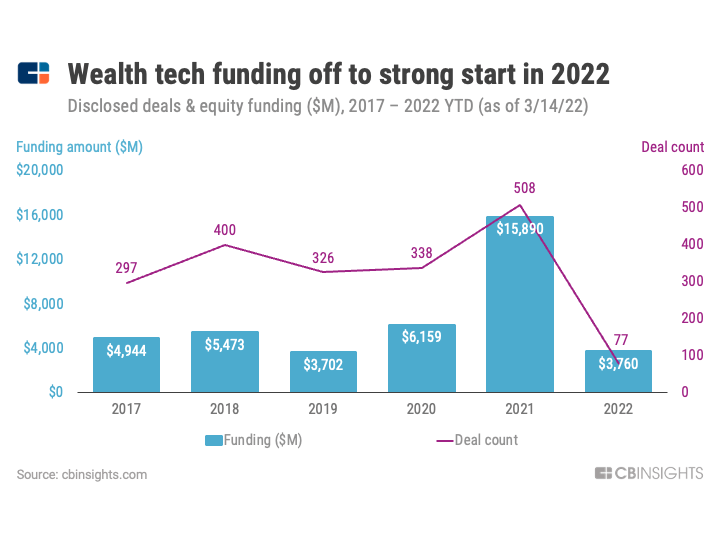

Wealth Tech

2,569 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

100 items

Altruist Patents

Altruist has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/23/2023 | Application |

Application Date | 3/23/2023 |

|---|---|

Grant Date | |

Title | |

Related Topics | |

Status | Application |

Latest Altruist News

Jan 9, 2025

The Culver City, Calif. RIA custodian let people go across spectrum of disciplines with hires focused on 'engineering, AI and go-to-market,' Jason Wenk explains Author Brooke Southall January 7, 2025 at 8:12 PM Keith Girard contributed to the editing of this article. January 8, 2025 — 2:09 AM Mr Wenk continues to be quite the controversial CEO...if these decisions were not cost related...why let them go at all? Things do not look too bright for them...sinking ship Brian Murphy January 8, 2025 — 3:37 AM An unnamed source who themselves was let go, explained that the company isn't growing...and also that the company is mean for not allowing them to go to the annual shindig.TBH, at least 10% of most every company are resource sucks. The sooner mgmt recognizes who they are and the quicker they let them go, the better. My guess is you're going to see more and more of this economic pruning in 2025. To me this sounds like a wise managerial move. You're either moving forward or falling behind. That said, it's an absolute abomination that those let go left with hurt feelings. Shannon Fung, CPA January 8, 2025 — 7:39 AM Brian Murphy please, u seem to lack basic reading comprehension. Jobs could have been saved if not for this shindig. Jason Wenks comments reek of bullshit and typical PR defense to me. I tend to take the side of impacted workers rather than narcissistic leaders!U Should go read the articles about RTO and the Glassdoor reviews. He has a negative reputation and seems sociopathic. IMO he is freaking out about Robinhood + TPMR acquisition and is restructuring for this reason, along with cost issues.He raves about growth as every startup does. But if you have for example 300 million in revenue but 350 million in expense, who cares? He didn’t even mention that bit. Curious Farah K January 8, 2025 — 8:41 AM everything ive read online screams we shouldn’t take the words of Jason seriously, he seems unhinged. forced RTO is already a sign of really bad leadership. add in layoffs and you’ve got hot garbage sitting on the top of the pyramid. curious to know why every startup that brags about record growth never discusses costs and losses? convinced this was both strategic and cost driven Brian Murphy January 8, 2025 — 6:50 PM Shannon - some jobs were not meant to be saved. The goal of a venture backed company is not to employ as many people as possible, it's to build a competitive & profitable company. If the 10% let go were doing things of value for the company, they would not have been let go. Mukesh M. Malhotra January 8, 2025 — 7:20 PM red flag: he did not mention cost at all,only percentages growth. these workers were let go to cut down on the costs I am certain. Ceo response seems to lack empathy a lot, red flag. green flag: reogrs are necessary to hit success, and the company seems desperate for that and willing to do whatevr needed to get it. Jason LinkedIn comments say not all were performances based on, so both cost and new strategy played role. GG January 8, 2025 — 8:28 PM Former Altruist employee here who left a while ago due to the strict RTO mandate, moving cross- country made no sense for my familia. Altruist is definitely growing from a metrics POV, no doubt, but internally the company had been struggling with growth for a long time. Retention was an issue, and so were the lack of career growth opportunities. Culture sucked, and brown-nosing kept you in good graces. While Jason had been a terrible leader during my time, I do think these changes were needed and he did the right thing. Must restructure and realign to compete with the monsters that are looming to dominate (looking at you, Robinhood). However, to suggest that this was not cost-driven at all is comedic. A leader can try to save face but when, online, the leader is eristic...doesn't help their comments seem legitimate.

Altruist Frequently Asked Questions (FAQ)

When was Altruist founded?

Altruist was founded in 2018.

Where is Altruist's headquarters?

Altruist's headquarters is located at 3030 South La Cienega, Culver City.

What is Altruist's latest funding round?

Altruist's latest funding round is Series E.

How much did Altruist raise?

Altruist raised a total of $449.5M.

Who are the investors of Altruist?

Investors of Altruist include Adams Street Partners, ICONIQ Growth, Sound Ventures, Granite Capital Management, Insight Partners and 10 more.

Who are Altruist's competitors?

Competitors of Altruist include Betterment and 3 more.

What products does Altruist offer?

Altruist's products include Altruist.

Loading...

Compare Altruist to Competitors

Public is an investing platform that offers a diverse range of financial products across multiple asset classes. The company provides tools for trading stocks, options, and cryptocurrencies, as well as investing in bonds, ETFs, and treasuries, complemented by high-yield cash accounts and tailored investment plans. Public also integrates AI-powered data and analysis into the investment experience, fostering a community-driven environment for sharing insights and educational content. Public was formerly known as TapX Trading & Analytics. It was founded in 2019 and is based in New York, New York.

The Motley Fool operates as a financial services company that operates in the investment advice and market research sectors. The company offers investing solutions, free guidance, and market analysis, providing stock recommendations, detailed analysis of companies, and portfolio-building tools. It primarily serves individual investors looking to achieve their financial goals. It was founded in 1993 and is based in Alexandria, Virginia.

Wellington-Altus specializes in independent wealth management and offers a range of financial services within the wealth advisory sector. The company provides holistic wealth planning, investment advisory, and wealth protection services to its clients. Wellington-Altus primarily caters to high-net-worth individuals and entrepreneurial advisors. Wellington-Altus was formerly known as Altus Securities. It was founded in 2017 and is based in Winnipeg, Canada.

Upvest is a financial technology company specializing in investment application programming interface (API) within the financial technology (fintech) sector. The company provides a platform for businesses to offer various investment experiences, including account creation, trade execution, and digital reporting. Upvest primarily serves the financial technology industry. It was founded in 2017 and is based in Berlin, Germany.

Wedbush Securities operates as a financial services company and specializes in wealth management, brokerage, and investment banking. The company offers various wealth management products and financial services such as financial planning, retirement planning, investment solutions, and a mobile app for client engagement. It also provides global clearing and execution services across all asset classes for various financial entities. The company was founded in 1955 and is based in Los Angeles, California.

Atomic specializes in financial services and investment management. The company provides a platform offering wealth management, savings accounts, fractional trading, and Treasury management services. Atomic primarily serves fintechs, banks, and consumer-facing companies looking to integrate investing experiences into their products. Atomic was founded in 2020 and is based in San Francisco, California.

Loading...